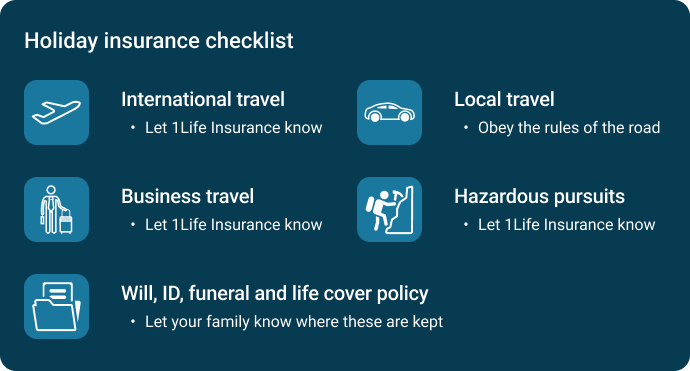

Do you know that travelling and taking part in a hazardous pursuit such as paragliding or bungee jumping can affect your life cover? This is what you need to tell your insurer about travelling and dangerous hobbies so that valid life cover claims can be paid!

Travelling abroad? Let 1Life Insurance know!

International travel allows you and your loved ones to experience more of the world! You can learn about other cultures, people, places and ideas as well as taste different cuisines! However, some countries are dangerous to visit, such as those where there is conflict and war. Life insurance companies generally won’t cover you in these countries as the risks of death are much higher than other countries you may visit.

You must let 1Life Insurance know if you are travelling abroad and for how long so we can let you know if we offer cover while you are overseas. Keep in mind that if we don’t offer cover, travel

If you've got a question our client services consultants are here to help. Leave your details and we will call you back.

Local travel and life cover

If your local travel (within the borders of South Africa) is for leisure purposes only, 1Life Insurance doesn’t need to know.

But, please keep safe and follow the rules of the road! All insurance policies exclude claims for events that occur while the life assured is engaged in criminal activities or breaking the law, such as exceeding the speed limit and/or driving under the influence of alcohol and/or drugs – so keep it legal!

Business travel

Business travel can also affect your risk profile, which in turn can affect your cover and/or premium. Which means 1Life Insurance does need to know if you travel for business outside of South Africa for more than 14 days as it may affect your cover.

Business travel is: Driving for work purposes during the day, such as visiting clients or suppliers.

Business travel is not: Driving to and from work each day.

You must tell us if you travel for work, as well as if you stop travelling for work such as taking a desk job, so we can be sure we offer the appropriate cover at the correct premium.

If your percentage of business travel increases due to your occupation you need to notify 1Life Insurance.

Taking up a dangerous hobby? There may be life cover policy conditions!

Dangerous hobbies or hazardous pursuits are activities that increase the risk of death or disability. These include, but are not limited to, activities such as:

- Rock climbing

- Scuba diving

- Paragliding and hang-gliding

- Fighting, such as boxing or cage fighting

- Speed contests such as motor bike or drag racing

These activities put you at a higher risk of injury or death when compared to ‘normal’ hobbies or activities. For example, your risk of becoming injured or passing away is a lot higher when you are paragliding than when you are taking a commercial flight from Joburg to Cape Town!

If you participate in an extreme sport, you need to let us know as it may affect your life cover. We may impose special conditions on your cover or exclude any claims that arise as a result of engaging in the hazardous pursuit.

However, if you participate once in a hazardous activity, such as bungee jumping while on holiday, you don't need to let us know.

Special conditions

1Life Insurance may adjust the sum assured or premium or apply an exclusion to your policy to reflect the higher risk of the dangerous hobby if you participate in it regularly.

Completing recognised training courses, such as a scuba diving certification, and following standard safety precautions such as checking equipment and wearing safety clothing may reduce the risks, but they may still be higher than standard risks, which will reflect in the premium and/or sum assured. Contact a skilled 1Life Insurance consultant for more information.

Exclusions

There are some activities that increase the risks of an early death and will be excluded from cover. One example is base jumping, known as one of the most dangerous activities! If you participate in one of these, cover may be excluded for events that happen while you are taking part in your hazardous pursuit!

Always let 1Life Insurance know if you are starting a hazardous pursuit so we can determine the risks and how they affect your cover. If we don’t know and something happens, we may decline the claim!

A final word: let your family know where to find your life file

Before you leave for your business trip or holidays, or that paraglide, make sure your family knows where you keep important documents, including your life and funeral insurance policy information, ID and will. If anything happens, your loved ones will need to know where these are kept.

Keep safe and keep your cover

Holidays are a time for family, friends and fun activities. These can affect your life insurance so always check in with your insurance company to find out if you are covered, and to be sure your family has the financial security they need!