Maximising returns for your clients with Tax-Free Investments

Financial advisers play a crucial role in the pursuit of tax benefit optimisation and a powerful tool at their disposal is the Tax-Free Savings Account (TFSA).

Unlocking the potential of TFSAs for your client

In South Africa, TFSAs allow individuals an opportunity to invest up to R36 000 annually, with a lifetime limit of R500 000. What makes these investments particularly enticing is their exemption from capital gains tax, dividend withholding tax, and tax on interest and other income, making them invaluable for generational wealth accumulation.

The beauty of TFSAs lies in their appeal to affluent clients and their potential for anyone. Even modest investments, over time, can grow substantially. As this article demonstrates, the more a client invests within the annual and lifetime limits, the greater their returns. Even after reaching the lifetime limits, leaving funds to compound further can significantly enhance long-term investment value.

Strategic timing for TFSA’s

To maximise TFSA benefits, it’s essential to reach the annual contribution limit before the end of the SARS tax year each February. March marks an ideal time to evaluate tax-free savings strategies, aligning with the start of a new tax period. Moreover, TFSA holders can move their tax-free savings account between financial institutions without penalties, allowing for optimisation and adaptability in their investment.

For clients to optimise their tax benefits, it's most beneficial to invest the full R36 000 in their TFSA within the tax year, as any unused portion cannot carry forward. Returns are maximised when the annual maximum amount is invested at the beginning of each tax year, allowing more time for funds to grow. However, for clients unable to invest the full amount annually, monthly instalments or investing smaller amounts are an option.

Harnessing the power of compound interest

One often overlooked advantage of TFSAs is the compounding effect on investments over time. It’s worth noting that even after reaching the lifetime investment limit, funds left in a TFSA continue to grow tax-free. The longer these funds remain untouched, the more substantial the interest earned on both the principal and accumulated interest, leading to significant long-term gains.

Starting early allows compounding to work its magic, transforming even modest investments into significant sums. This makes TFSAs an excellent option for those starting their investment journey and wanting to accumulate funds early for retirement; and those planning for a child's future.

Investing for a child from birth, while maximising annual contributions, could help build substantial savings by the time the child reaches their teenage years. These savings could facilitate major life events like property purchases, education, or entrepreneurship.

At the same time, those wanting to set themselves up for a more comfortable retirement could increase their retirement savings, by leaving their TFSA to accumulate until the age of 65.

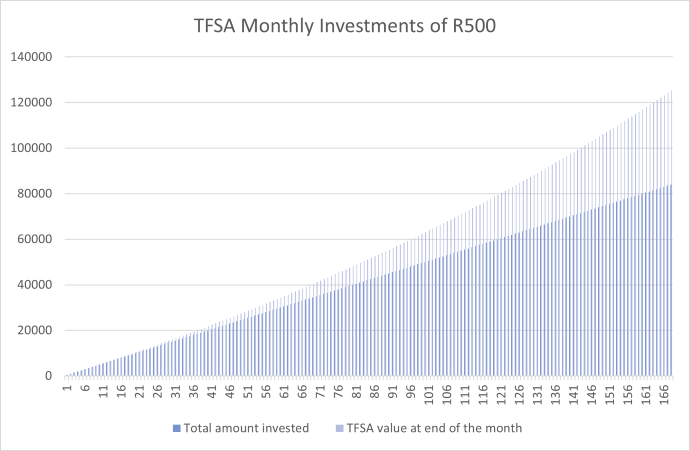

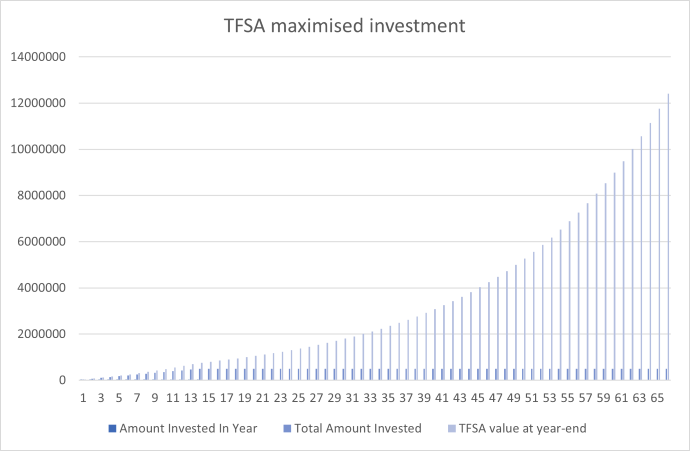

Let’s consider a couple of scenarios. We will be using targeted real return rates of one of the 1Life investment options of 5 – 6%. A real return is return in excess of inflation. By removing the expected impact of inflation, the amounts are effectively expressed in today’s value terms.

Scenario 1: Small investments, a big impact on helping a child build a nest egg

Illustratively, even a monthly investment of R500 into the 1Life TFSA from a child’s age of four could accumulate to around R125 353 (in today’s terms) by their 18th birthday.

Scenario 2: Long-term perspective: From childhood to retirement

Consider the scenario of ramping up investments in a TFSA for maximum benefits over a longer period. Investing the maximum annual amount (R36,000) for a child from birth could reach the lifetime limit just before their fourteenth birthday. Almost R950,000 (in today’s terms) would be available by the child's 18th birthday. Extending this investment until the child turns 25 could grow this amount to R1.38 million, providing a substantial resource for endeavours like starting a business or a family.

Alternatively, holding onto the investment until age 65 could yield an impressive R12.41 million, offering a comfortable retirement fund. It's crucial to acknowledge that investors' circumstances vary, and there's flexibility to tailor investment approaches accordingly. Lump-sum investments starting from as little as R5 000 are also viable options.

In conclusion, tax-free investments present a unique opportunity for South Africans to build generational wealth, leveraging tax benefits and the power of compound interest. By strategically utilising TFSAs, individuals can secure a financially stable future and reap the long-term advantages of tax-free investment growth. Consult with your financial adviser today to explore your options further.

Read more about the 1Life TFSA here.