Starting a new job or been promoted? Congratulations and good luck! A new job is a big change, and it could mean you need to review your life insurance to make sure your policy still covers you and your family. You can use our quick and easy three-point checklist below to help with your review.

1. Tell your insurer you have a new job

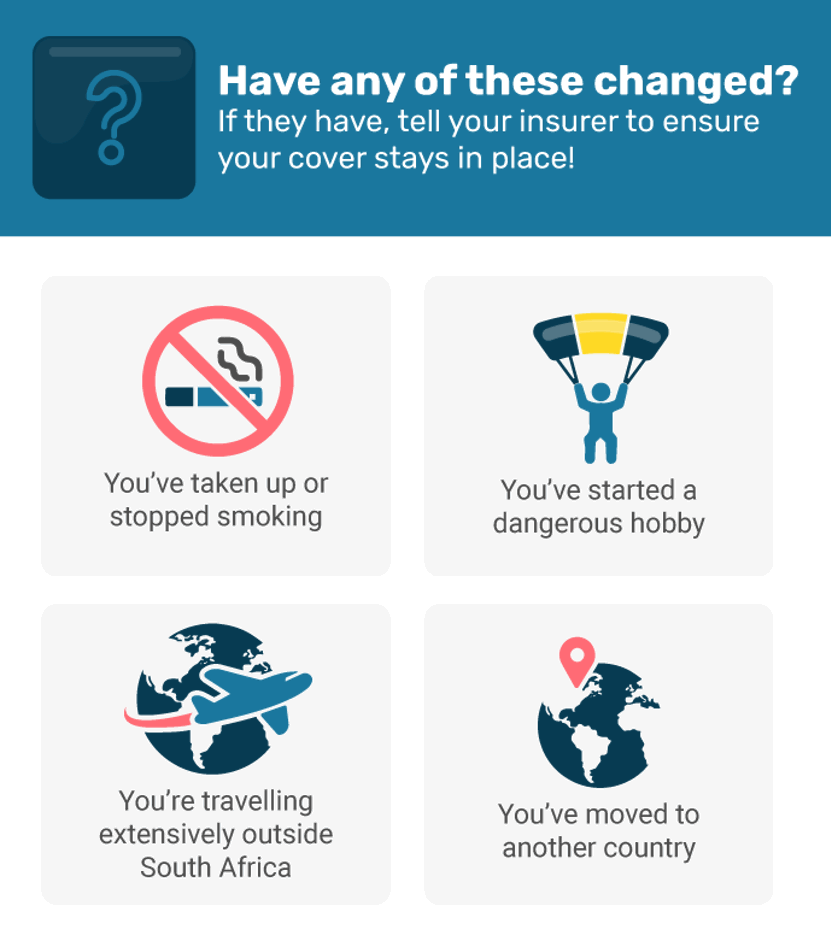

Why? Your cover and premium is based on your risk profile, which is determined by various factors such as your education and occupation, and how much and where you travel. Change your occupation and your risk profile, cover and premium may change. You may even qualify for a lower premium!

What to tell your insurer: What your new job is, how much travel it involves and if it is more or less than your previous job. Travel applies to travel for work in and outside SA, not travel to and from work.

What happens if you don’t inform your insurer? A significant change to your risk profile or extensive travelling could mean your cover is no longer valid and a claim may be rejected, or a lower sum assured paid on a claim.

1Life policyholders need to advise us of any change in occupation within three months of the change.

Top tip: Your job is your primary occupation. You don’t need to tell your insurer about a change in or a new side hustle unless it is dangerous or hazardous, such as taking people on zip line tours on the weekend.

Related posts

2. Review your sum assured

Why? A new job or promotion may mean a higher salary, which you can use to improve your family’s standard of living. For example, you might send your children to a better school or buy a bigger family home. To ensure this standard of living can be maintained if you pass on, you may need a higher sum assured. You should also take into account any benefits that are part of your new salary package, such as group life cover, as this will affect how much cover you need on your individual life policy.

What to tell your insurer: If you want to increase your sum assured and by how much. They will advise of any changes to cover and the premium payable. Your financial adviser or a 1Life call centre agent can also complete a financial needs analysis to ensure you have the right amount of cover for your needs.

What happens if you don’t review your sum assured? You could be underinsured. If you pass on, meaning your family will receive a pay out that isn’t sufficient to cover all their living expenses and the debt on the family home and car, for example. This might mean a drop in their standard of living.

3. Update your personal details

Why? Your details may have changed, which could mean we can’t contact you.

What to tell your insurer: If any of the following details have changed:

- Email address

- Cell phone number

- Residential address

- Bank details

- Debit order date - you may be paid on a different date and want to change your debit order date to match your salary payment date

What happens if you don’t tell your insurer? You may not receive important information relating to your policy or your debit order may bounce, which could affect your cover and a claim.

How to update your 1Life policy

You can update your details on our online policyholder servicing portal, or contact us on 0860 10 51 94 for any changes to your sum assured.