Claim paid! That’s what you really want from your 1Life Insurance policy, and it’s our commitment to clients who submit valid claims. But, there are a few steps to take before a valid claim can be paid! We asked our 1Life Insurance claims team to explain how the claims process works, and what you need to do when, so you know what to expect when you claim on your 1Life Insurance policy.

Four steps in the claims process

All claims are assessed, and the time taken for each step depends on the policy and details of the claim.

Step 1: A claim is made by a beneficiary on a life policy, or main member or beneficiary on a funeral policy

When a person covered on a 1Life Insurance life or funeral cover policy passes, you need to call the 1Life Insurance claims team on 0860 10 51 96, Monday to Friday, 8am to 5pm, and let them know the person has passed and that you want to claim on a policy. This will be the start of the claims process. You will need the policy number and ID number of the deceased on hand, before contacting 1Life Insurance.

If you've got a question our client services consultants are here to help. Leave your details and we will call you back.

Step 2: The claim is registered

This takes place while you are making a claim telephonically. Documentation will be requested such as ID documents, death certificate and death notice. Your undertaker or healthcare practitioner can help with these documents or you can obtain them from the Department of Home Affairs. We will also require confirmation of bank details, either a bank statement not more than 3 months old or a bank confirmation letter, to ensure we pay the correct beneficiary!

Step 3: The information and documentation provided is assessed and verified

The 1Life Insurance claims team will assess the claim and documents submitted in detail to determine if it is a valid claim. They will also check the application for life cover policies to ensure there has been full disclosure of all health conditions and occupation.

At this stage, further information may be requested, such as medical reports from an attending healthcare practitioner or institution such as a hospital, or a police report if the death is due to a motor vehicle accident or crime.

Your dedicated 1Life Insurance claims consultant will advise you of any further information required, or they will contact the healthcare practitioner or institution for their reports. They will also keep you updated on the status of the claim. You can speak to your dedicated claims consultant at any time. They are assigned to your case and will work with you to finalise the claim.

Step 4: The claim is finalised and valid claims are paid

You will be notified of the outcome of the assessment and valid claims will be paid. Valid funeral claims are usually paid within 24 business hours, often in real time if your bank allows for real time payments.

If your claim is declined or reduced you will be notified, with details on how to dispute the outcome of the claim, which you can also find on our website.

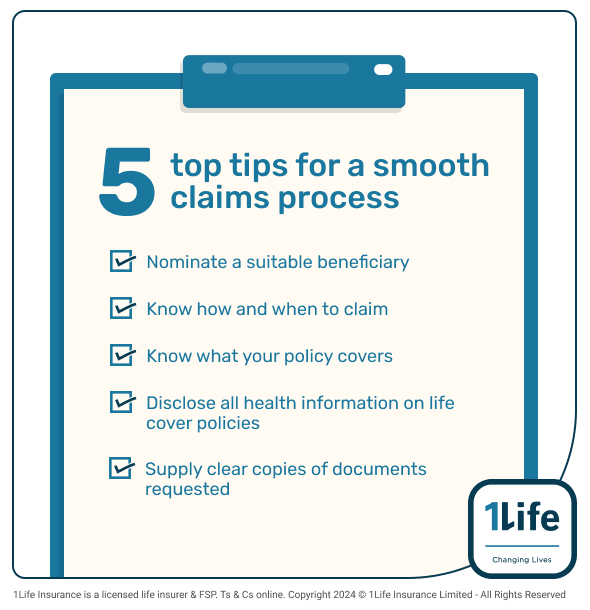

Reasons for delays in the claims process and tips to ensure a smooth claims process

Reasons for delays in assessing and paying valid claims include:

Documentation delays

It can take time for us to receive requested documents and reports, in particular reports from healthcare practitioners and institutions such as public hospitals. This will delay the assessment process. We follow up regularly on reports requested but not yet received. These delays apply to life policy claims and will only rarely delay a funeral policy claim assessment.

It can also happen that a document sent to us is unclear, such as an ID document, which means we have to ask you to submit these again.

Top tip: Submit documents requested and ensure they can be clearly read. Also make a note of any attending healthcare practitioners at the death so we have their details.

Policy terms and conditions have not been met

These include paying premiums on time and fully disclosing all material information requested on your life cover application form. Claims will be delayed, and possibly reduced or declined, if there are unpaid premiums and/or if there is non-disclosure, such as the life assured not mentioning they have a chronic condition on their application form. You can read more about non-disclosure in this blog.

Top tip: Go through your policy documents and make sure you understand all the important terms and conditions. You can access your policy documents on our online policyholder service portal or WhatsApp service centre. Ask your financial adviser or a skilled 1Life Insurance consultant if you are unclear on what waiting periods apply to your policy.

Claims are made for death due to natural causes on a life cover policy where the life assured has not taken their HIV test

If a life assured on a 1Life Insurance life cover policy does not take their HIV test, they have cover only for death due to accidental causes, as specified by 1Life Insurance. An accidental death is death due to a sudden and unforeseen event occurring at an identifiable place and time, such as a car accident.

Top tip: You have three months from your policy commencement date to take your HIV test. If you have not taken your HIV test, do so today! You can find a lab or pharmacy on our website and book your test!

The beneficiary is a minor

South African citizens under the age of 18 cannot be paid an inheritance or payment from an insurance claim. If the beneficiary is a minor, the claim needs to be paid into a trust or into the Guardians Fund, which will delay the claims process.

Top tip: Nominate a suitable beneficiary! You can read more on who is a suitable beneficiary in this blog.

The relationship of an extended family member to the main member on the funeral policy is unclear

Extended family members on 1Life Insurance funeral policies need to be related, and have a recognised relationship, to the main member, such as additional spouses, brothers, sisters, brothers-in-law, sisters-in-law, parents, parents-in-law, aunts, uncles and cousins.

Top tip: Check that all the members covered on your policy are related to you and advise 1Life Insurance or your financial adviser of any changes.

Claims are made outside the time limit

You need to claim on a 1Life Insurance policy within six months of the death of the insured person.

Unfortunately, many claims are submitted outside the time limits, and these claims may be delayed or declined. One of the main reasons for a delay in claiming is because the beneficiary does not know there is a policy they can claim on.

Top tip: Let your loved ones know you have a policy and who and what it covers so they can claim when they need to.

Claims are made for an event not covered in a waiting period

While these claims will be declined, there will be delays in the claim assessment phase as we need to determine if the waiting period applies.

A waiting period is the time in which a policy is in force and premiums must be paid, but death due to certain events is excluded.

1Life Insurance funeral cover policies have a waiting period for death due to natural causes of six months and six premiums paid.

1Life Insurance funeral cover policies have an exclusion for death due to suicide of 12 months, and 1Life Insurance life cover policies have an exclusion for death due to suicide of 24 months (two years).

Top tip: Check your policy documents to see if any waiting periods apply to your policy.

We’re committed to a good claims experience

We are committed to paying valid claims as quickly as possible and keeping you updated on the status of your claim! You can help us by ensuring you submit all the documentation we request in good time, and paying your premiums when they are due. And, make sure your family knows what policies you have so they can claim when the time comes!